A checklist for ETF tax diligence

Explicit and implicit tax costs should be bundled with expense ratio to tell the "total cost" story of holding an ETF.

I can usually tell how tax-efficient an ETF is in about 30 seconds

Assuming you’ve got all the tax ju-jitsu in your brain, the prospectus will mostly tell you what you need to know.

Oh, it’s techy/healthcare growth stocks? It's probably pretty tax-efficient because there's no dividend drag.

Oh, Cathy Wood manages the fund? Well, there are probably a lot of capital losses that can be used later.

Oh, it’s a treasury bond fund? It regularly pushes ordinary income to shareholders, so that’ll be a drag.

Etc.

That’s the straightforward stuff.

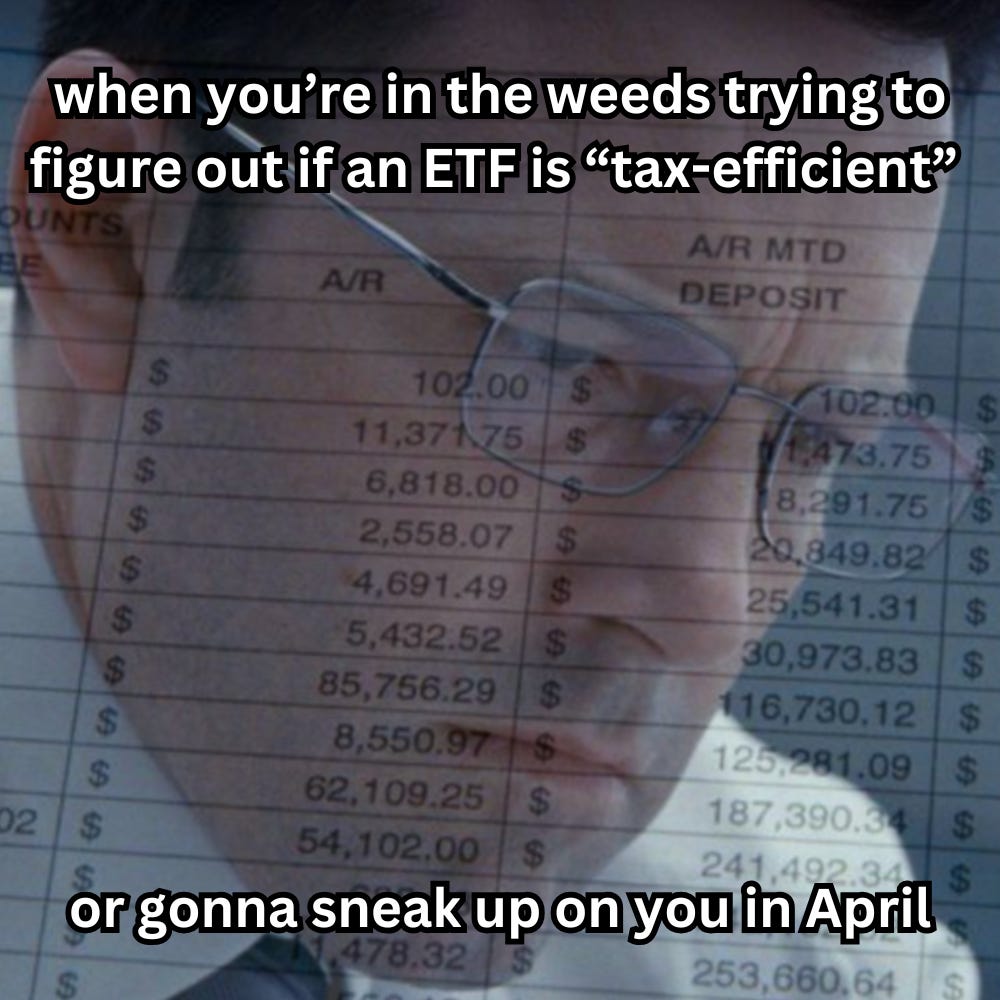

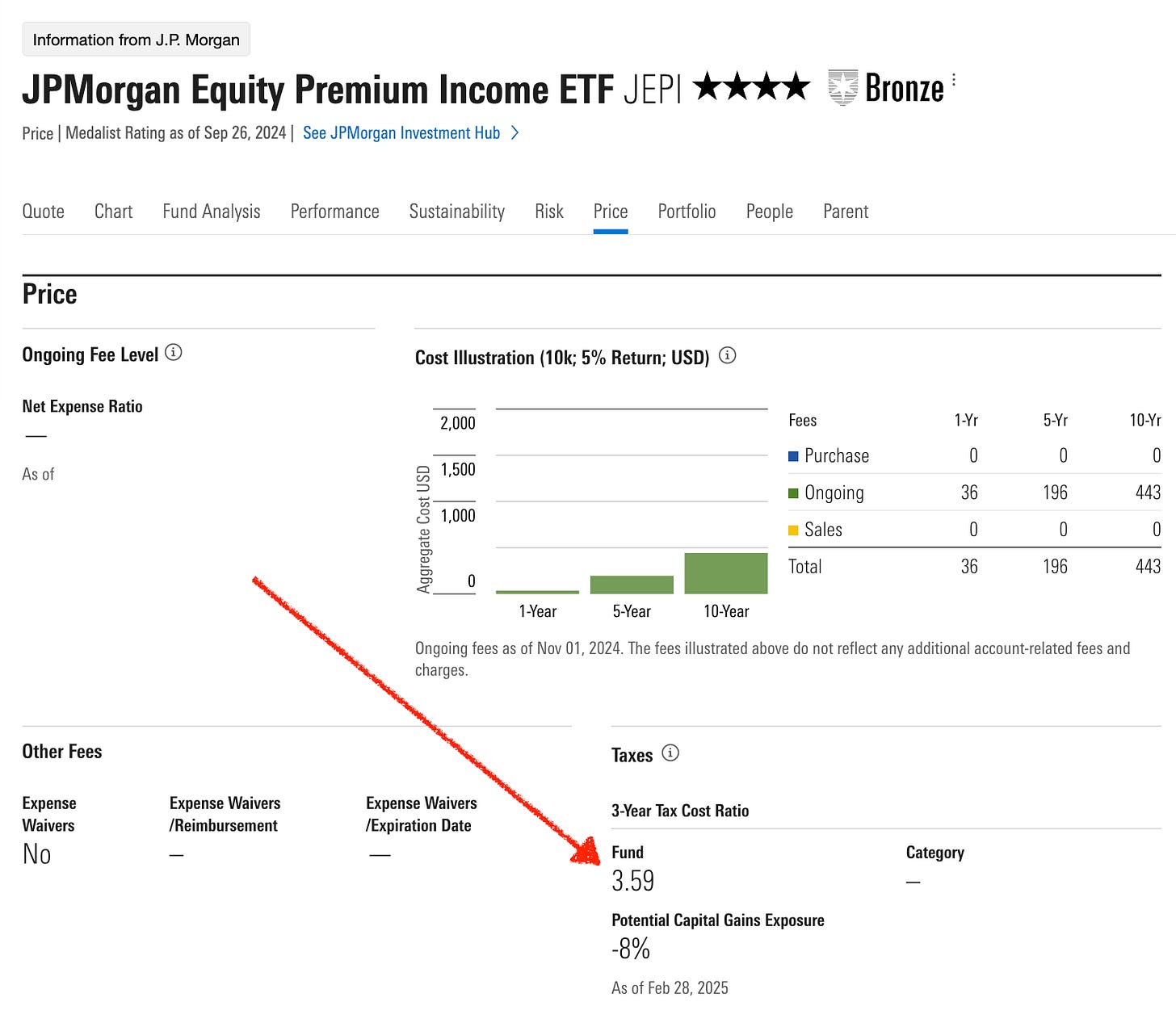

That stuff is so straightforward that Morningstar’s Tax Cost Ratio is sufficient.

Investors can go look it up for free (though somewhat awkwardly on the “Price” tab of an ETF’s Morningstar page) to get a feel for an ETF’s tax efficiency (hint: close to zero is good. VTI’s is 0.39% 3-year, iShares 20+ Year Treasury Bond ETF TLT is 1.35% 3-year).

For example, here’s JEPI giving us the “income” of a bond, a fraction of the upside of stocks (and all of the downside), but somehow less tax-efficient than either (see the Tax Cost Ratios above). That’s a whole other story.

I’ve said this before, but I think Tax Cost Ratio should be visually presented immediately next to expense ratio. Yes, tax is personal. And yes, it changes every year. But…

taxable investors should know the “total cost” of the products they’re buying

I have many thoughts about Morningstar’s Tax Cost Ratio, but I generally like it. I wrote a whole article about where it’s great and where it falls short…

Why I Love/Hate Morningstar's Tax Cost Ratio

In early 2001, SEC issued a rule called Disclosure of Mutual Fund After-Tax Returns, aiming to help investors understand how tax impacts returns.

Tax Cost Ratio quantifies an ETF's tax burden by examining its distributions (interest, dividends, capital gains, etc.) and slicing off some portion for taxes to calculate “pre-liquidation” after-tax returns.

The trouble is that…

An ETF is taxed in many ways beyond its distributions.

For instance, return of capital (distributions beyond the Section 852 requirement) is not taxable. However, since a return of capital lowers the shareholder’s cost basis, they will owe more tax when they eventually sell (assuming they don’t reinvest the returned capital and put the basis back where it was).

This isn’t good or bad. It is just something investors need to consider before hopping into a product known for returning capital.

Another example is when shareholders buy ETFs. The infamous case is “buying a dividend,” where investors purchase shares just before the upcoming ex-dividend date and promptly receive their capital back… with a tax bill.

Since there are so many explicit and implicit cases to remember when figuring the tax cost of holding an ETF, I made a checklist.