Tax-aware long/short strategies like the 130/30 (get up to speed here) require margin and shorting. It works like this:

Investor contributes $100 cash or securities

Manager borrows $30

Manager shorts $30

The gross portfolio is $160 (= $100 + $30 + $30).

Borrowing isn’t free. It usually costs Federal Funds Rate + X

Investors who borrow and sell shares receive proceeds that sit in a collateral account collecting interest. They receive the interest minus some amount, Federal Funds Rate - Y.

Sometimes, there are other fees, but let’s not worry about them for now.

So, the “spread” is FFR + X - (FFR - Y) = X + Y.

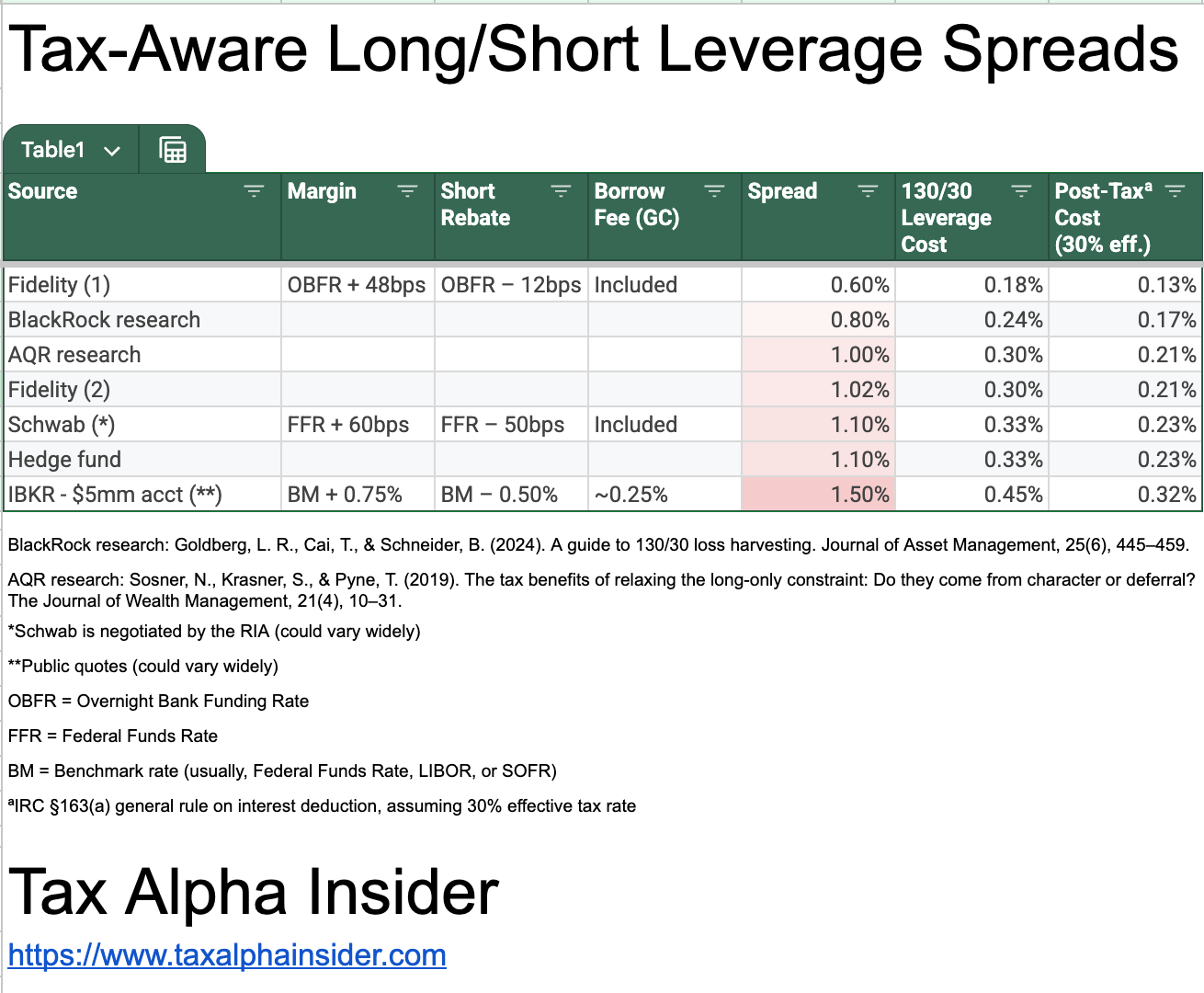

Based on several folks familiar with the matter, here's what actual spreads look like.

100 basis points is the rule of thumb

The size of the total relationship usually drives spread. Scale is an advantage.

Since margin and borrowing costs only apply to the portfolio extensions (the 30% margin and 30% short), we can multiply the spread by the extension size to get the pretax leverage cost.

Taking the Schwab quote as an example: if the spread is 110 basis points, then the actual pretax cost to the investor is 33 basis points (= 60bps * 30% + 50bps * 30% = 110bps * 30%).

The borrowing cost is tax deductible

There are three things to know about the tax treatment of portfolio interest expense1:

It is tax deductible per IRC §163(a)

It is limited by net investment income:

Including: Interest income, non-qualified dividends, short-term capital gains, and more

Excluding: Qualified dividends, long-term capital gains (unless you make an election)

It carries forward if unused

Returning to our Schwab example from above, assuming a 30% effective tax rate, the post-tax 130/30 leverage cost is 23 basis points (= 33bps * (1-30%)).

Quick aside: The IRC §163 interest expense deduction is unrelated to the IRC §212 itemized deductions phased out by the Tax Cuts and Jobs Act of 2017, including investment management expenses. “The TCJA temporarily eliminated most miscellaneous itemized deductions, such as investment/ advisory fees, legal fees, and unreimbursed employee expenses. These deductions will once again be allowed, starting Jan. 1, 2026, under the previous rules, to the extent they exceed 2% of the taxpayer’s adjusted gross income.” (The Tax Adviser)

Some folks assume that the margin rate is what investors pay for tax-aware long/short strategies. Something like the Federal Funds Rate + Y, which today might be 4.33% + 100 bps = 5.33%; however, short rebate and competitive margin make the strategy viable.

Tell me the rates you are seeing

Are you seeing different rates? I’d like to hear spreads and other costs per custodian by relationship size. I will update the table as I learn more.

Thanks for reading.

IRC §163(a) says “There shall be allowed as a deduction all interest paid…” and §163(d)(1) says it “…shall not exceed the net investment income…” but also §163(d)(2) says unused expense carries forward.

There’s a more palatable version of all of this in IRS Pub 550.

Net investment income is stuff like interest income and non-qualified dividends, “In general, qualified dividends and net capital gain from the disposition of property held for investment are excluded [author’s emphasis] from investment income.” (see IRS Form 4952 to learn more). Any carry forwards are captured in line 7.