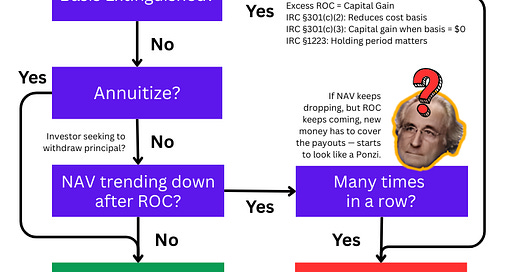

Is ETF return of capital a Ponzi Scheme?

Many ETF sponsors brag about the tax-efficiency of returning capital, but that's only part of the story.

Other reading from the world of taxable wealth:

[podcast] Rabbithole with Dave Nadig

[podcast] BlackRock's Family Office audiocast series: long/short strategies as the next big industry disrupter.

Alliance Bernstein: It’s What You Keep: Why Focusing on After-Tax Returns Matters

IMTC (bond port mgmt) partnerships: Franklin Templeton, T. Rowe Price

ETF Architect: How to convert, tax-free, SMA assets into an ETF

Robinhood: Introducing Tax Lots on Robinhood (it’s about time?)

ETF return of capital

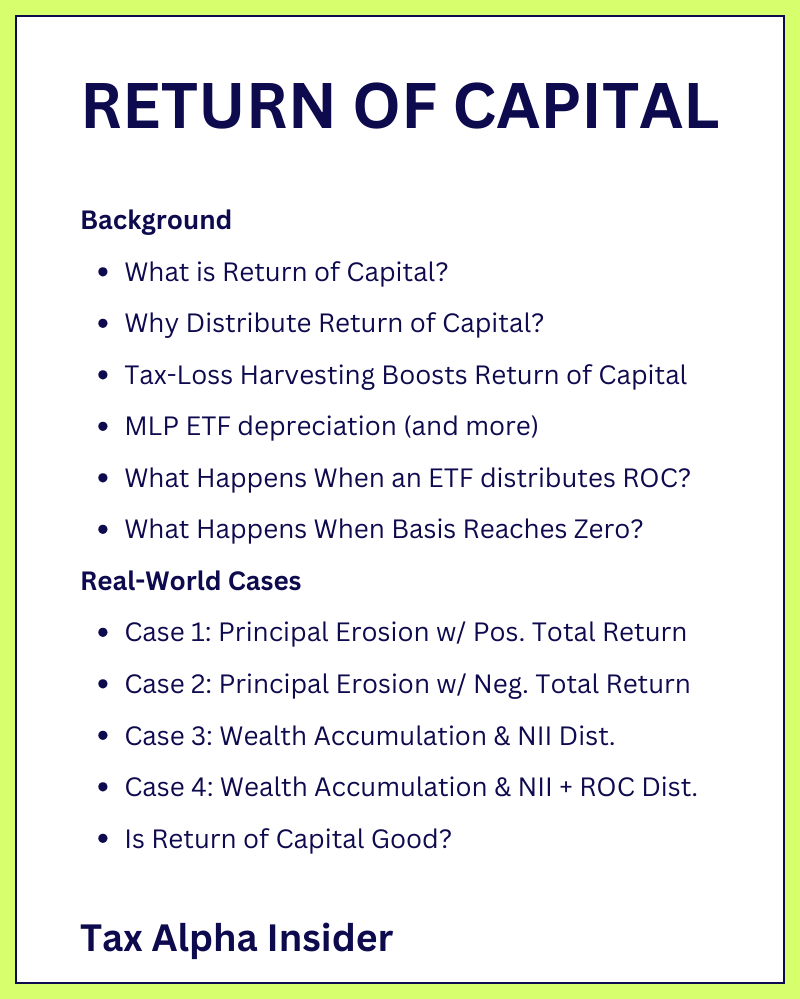

Return of capital is a popular way for ETFs to make distributions because they are not taxed.

ROC is also widely misunderstood.

Return of capital is not all good. It is not all bad. It’s rarely a Ponzi Scheme.

The flowchart above helps readers understand the quality of the return of capital distribution in context.

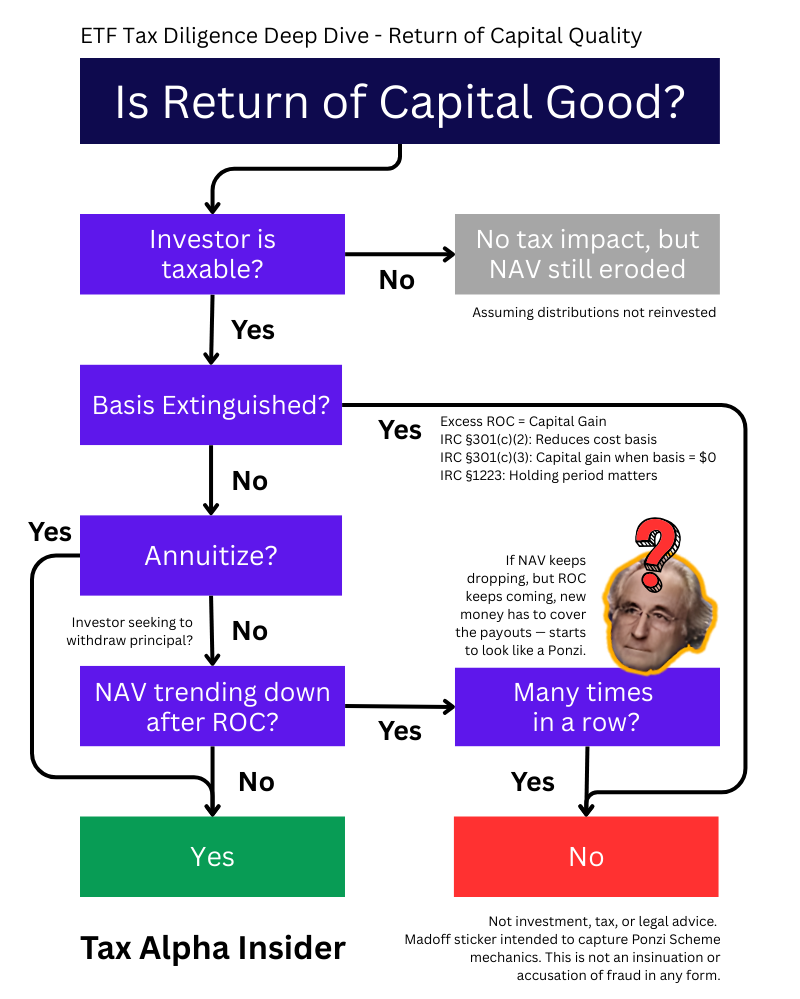

I’ll be on Dave Nadig’s podcast soon talking about return of capital in detail.

Here are the mobile-friendly slides I updated to prep for recording.