Tax-aware long/short... what if the long is an ETF?

A novel approach to the 130/30 is compelling, but has a few tradeoffs

Happy Easter, Passover, or simply good weather. Thanks for reading today.

The folks at Burney Wealth Management are doing something interesting

They reached out about their tax-aware long/short strategy, and the timing was right since I was already neck-deep in tax-aware long/short research.

They have a unique approach, which, amazingly, incorporated a Section 351 conversion (see my guide to seeding an ETF in-kind via Section 351), so I couldn’t resist taking a closer look.

If you’re new to tax-aware long/short strategies like the 130/30 or 150/50, this post will get you up to speed.

The quick and dirty is that managers will “extend” traditional long-only separate accounts with shorting and margin.

For example, they may create a 130/30 portfolio by doing the following:

Receive $100 of cash (securities too, but table this for now)

Add $30 of margin

Short $30 of individual names

The gross portfolio size is $160 (= $100 + $30 + $30) and usually has a beta approximately equal to the market (though market-neutral versions are possible, too).

There are two reasons for adding leverage:

To more clearly reflect a negative view on individual names

To defray active rebalancing costs by tax-loss harvesting the shorts when the market is up and longs when the market is down

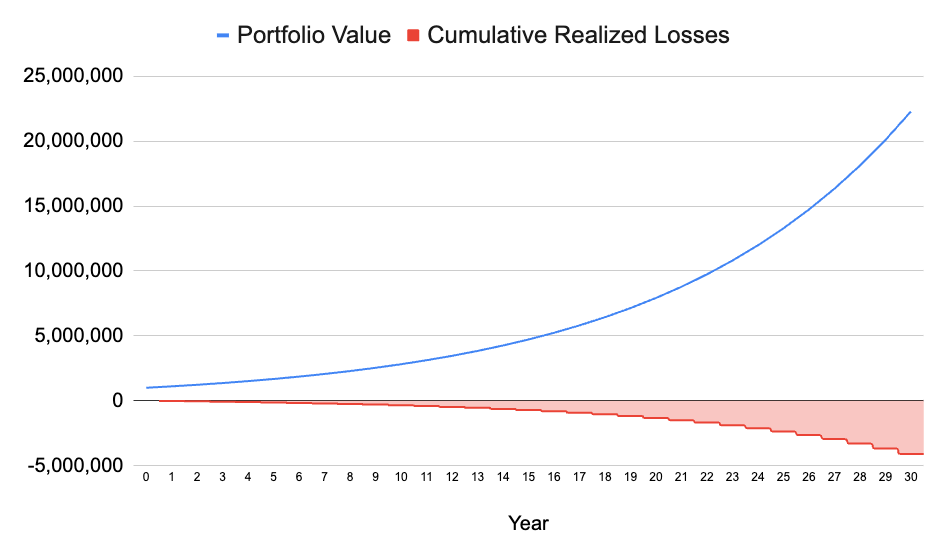

I replicated Burney’s analysis illustrating capital losses as a hypothetical portfolio grows over time.

Their portfolio minimum is $250k, making it the lowest access point to 130/30 that I’ve seen.

This article is about Burney’s novel approach to managing a tax-aware long/short strategy, what it costs to operate, and how it is different from a typical 130/30 implementation.

The typical way to do this is with individual names

Every single position in the 130/30 is an individual name.

But since a long/short portfolio is active, it trades more regularly than a passive portfolio. This usually means realizing capital gains, which creates portfolio tax drag.

In a typical 130/30 implementation, tax-loss harvesting makes rebalancing less painful since there are opportunities to harvest sizeable chunks of the portfolio in up and down markets.

Side note: Tax-aware long/short portfolios have a few more advantages, that are not the focus of this piece, including:

More opportunites to capture the difference in short vs. long term tax rates

What I’ve previously called “synthetic cash injection”

However, active ETFs have managed to avoid realizing capital gains for years using the magic of the ETF wrapper, could they somehow be incorporated? Yes, it turns out.

If you need a refresher on the mechanics of the heartbeat trade, I highly recommend Elisabeth Kashner’s “The Heartbeat of ETF Tax Efficiency”, which I’ve decided is so valuable that I now carry around a pocket-sized copy with me at all times as some carry around a tiny Bible or US Constitution.

For example, the ~$30 billion Dimensional US Core Equity 2 ETF (DFAC) is actively managed and has not distributed a capital gain in its lifetime (listed 06/14/2021).

Burney Wealth Management combines the perks of the active ETF with the perks of the tax-aware 130/30.

Tax-aware long/short... the long is an ETF?

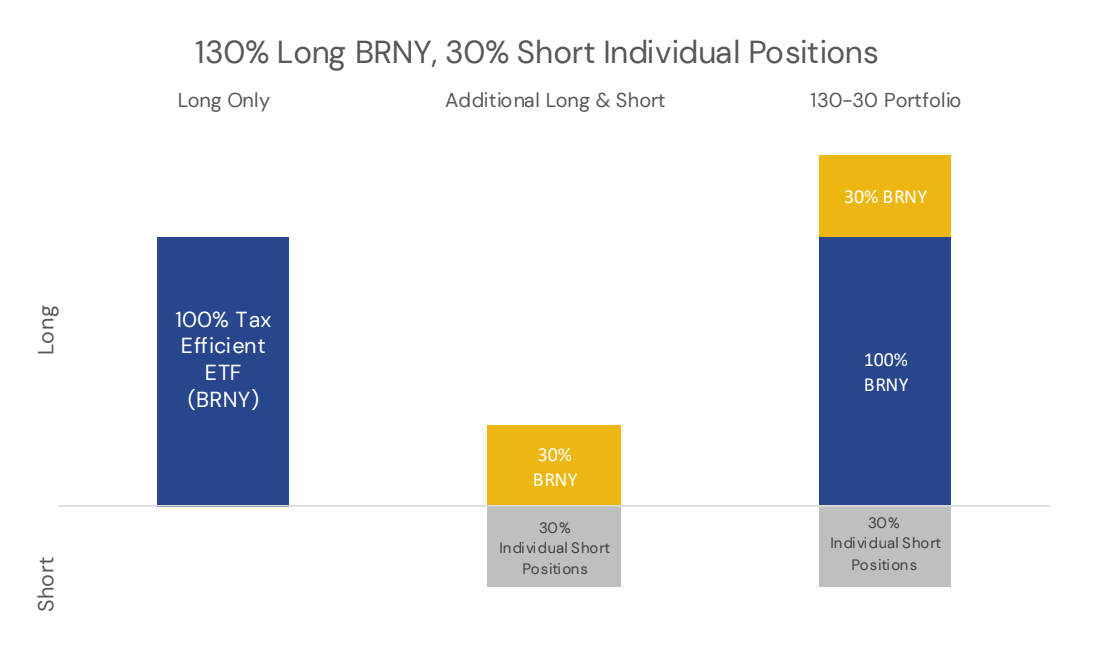

Here’s how Burney rolls its 130/30 using an ETF for the long.

Receive $100 cash

Add $30 margin

Buy $130 of their own ETF (BRNY)

Short $30 of individual names

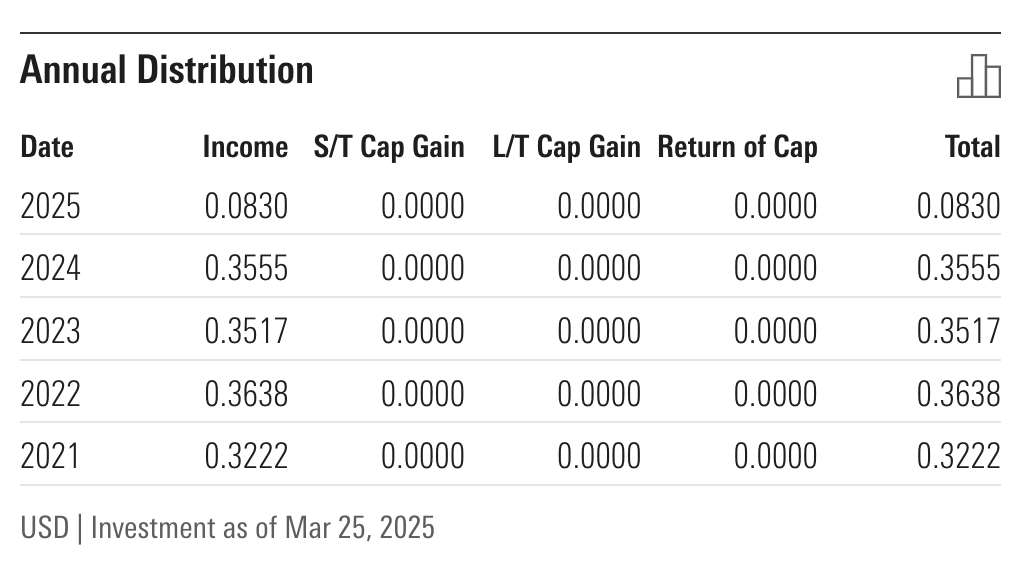

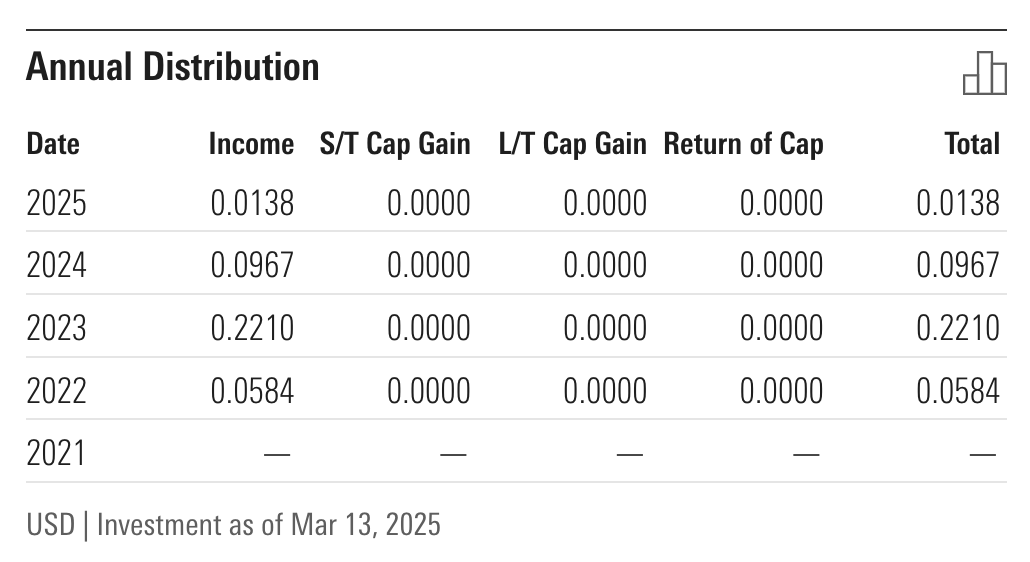

The ETF tax efficiently defers capital gains, as we see on the Morningstar distro page (i.e. nada).

Plus, the ETF wrapper has more fee magic than the separate account wrapper. In short:

Fees are “tax-deductible” (actually a tax shield)

“Management fees in an ETF can be netted against dividends, interest, and income, implicitly making them tax-deductible.” (blog post on this forthcoming)

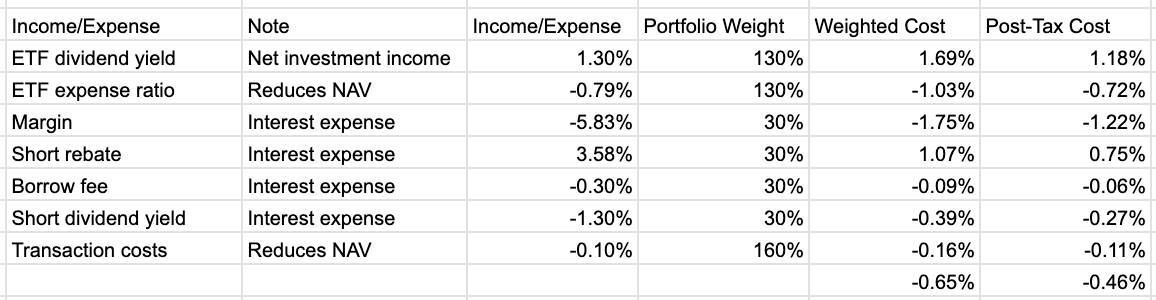

Moreover, the folks at Burney don’t charge a separate account fee, so the ETF’s expense ratio (79 basis points) is what the investor pays…

…except there’s a catch:

In a typical 130/30 separate account, the manager only charges on net assets. In other words, fees are calculated on $100, not the $160 gross.

However, with Burney’s implementation, even considering the no-fee SMA, investors pay fees on $130 long. So, 79 basis points is actually more like 102.7 (= 79 * 1.3) basis points.

But, again, this needs to be weighed against the ETF fee tax shield and more (which I do later in this post).

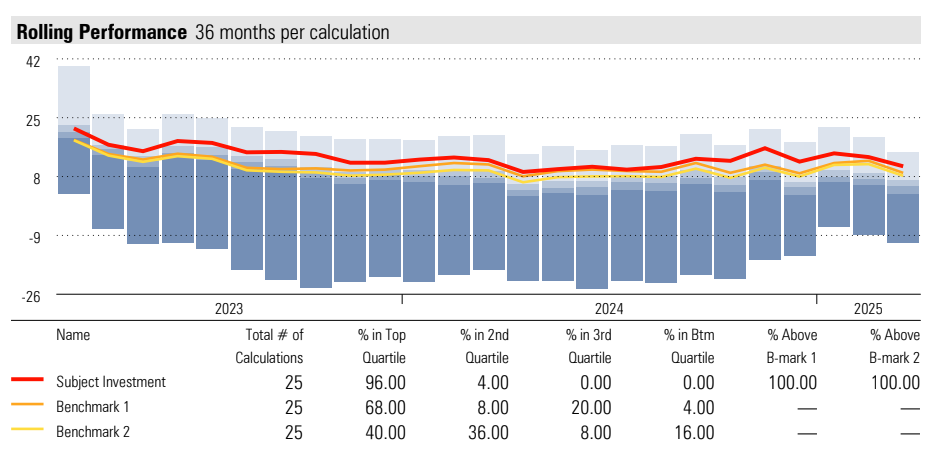

Their active approach has top-quartile performance in all trailing 36-month windows, except one.

Presumably their after-tax results are also competitive given the vast and sustainable capital losses a 130/30 strategy typically produces, essentially smoothing or flattening the tax cost of rebalancing.

Tax Cost Ratio

The heart of the SMA is the ETF, Burney U.S. Factor Rotation ETF (BRNY), which has a 1-year TCR of 0.21%.

The SMA is benchmarked to the Russell 3000, so, for comparison, the Vanguard Russell 3000 ETF (VTHR) has a TCR of 0.42% (3-year annualized).

The 0.79% expense ratio nets with dividends to lower taxable distributions, which, interestingly, makes the fund more tax-efficient.

This is another reason why I love/hate Morningstar’s Tax Cost Ratio: It is a solid framework that only tells part of the story.

Payment in lieu

Setting aside any net capital losses passed through the SMA, investors likely experience very little dividend tax drag because the short positions collecting dividends must forward those dividends to lenders. These payments further decrease dividends passed to the end investor.

This is just another example of a tax shield.

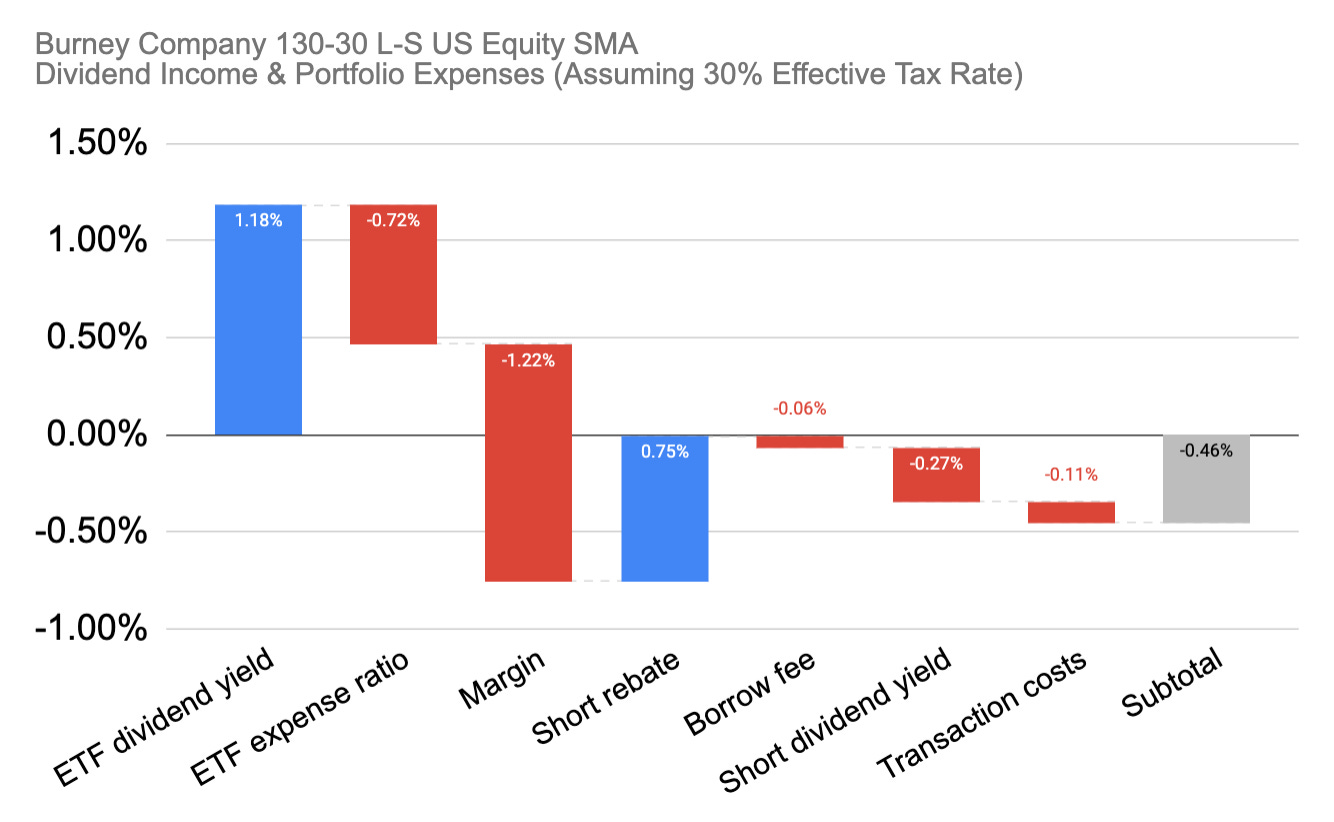

Total cost of ownership

Income and expenses are not exactly nettable, but the expenses are all tax-deductible (directly or indirectly), and summing their post-tax value brings us closer to the actual cost of operating a 130/30 strategy that holds a relatively costly ETF.

My estimate is a post-tax cost of 46 basis points.

Assumptions…

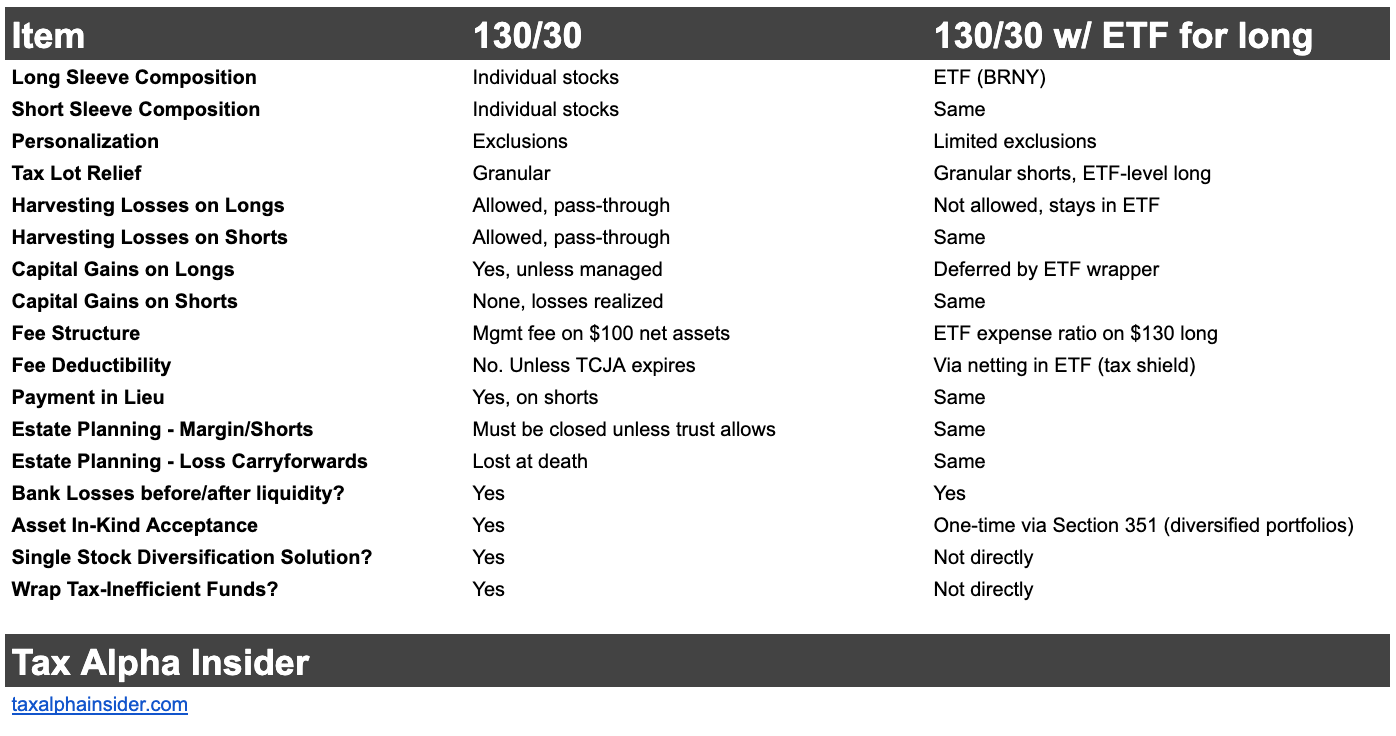

Tradeoffs of using an ETF

The ETF cannot accept assets in kind.

Well, one time it could.

The folks at Burney cleverly seeded BRNY in-kind via Section 351 (administered by ETF Architect).

But that is a one-time opportunity. It would take launching a new ETF to open the seed window again.

Moreover, Section 351 conversion is great for diversified portfolios but, a very common use of 130/30 strategies is diversifying single-stock positions or wrapping tax-inefficient mutual funds, which would breach the Section 351 25/50 diversification rules, and the in-kind redemption requirement, respectively.

Long harvested losses stay captive in the ETF wrapper

In a typical 130/30 implementation, long positions of individual names would be harvested and passthrough for use elsewhere in the investor's total household portfolio.

Burney, instead, argues that this benefit dries up (they're not wrong) and investors are better served by the tax-efficiency of the ETF wrapper.

Another nuance is that they can't harvest the total ETF since their fees would disappear.

Estate planning

This is not specific to the ETF case, but while I have the hood open, investors need an estate plan so they don't have to unwind the margin loan and short positions, which could be very costly.

By default, an estate must close all debts, including margin loans and shorts. But a trust with authority to hold a margin loan and shorts could allow the benefits of the strategy to continue for future generations. Consult an estate planner.

Another estate concern is using carryforward losses, since they cannot be bequeathed. In the odd case of positions trading below cost basis, heirs might actually get a step down in basis. Just something to keep in mind.

Tradeoff summary

This is mostly tax analysis

Tax-efficient access to an alpha strategy is valuable if you believe it will be successful. Passthrough capital losses delivered in near perpetuity (via the shorts) squeeze more juice out of the same invested dollars.

Does tax-aware 130/30 need the ETF wrapper? The shorts can be rejuvenated as the market grows, creating nearly limitless harvesting potential, which may be sufficient to quash gains realized from rebalancing.

I think the quartile rankings mentioned earlier tell a compelling story about the pretax performance of Burney Company 130-30 L-S US Equity SMA. However, like any investment, it has trade-offs that investors need to consider, including continued success of the alpha strategy, fees, and tax. Hopefully I’ve captured nearly all of them above.

Thanks for reading.

Disclosure: This post was originally paywalled. A sponsor covered the cost to make it public. No edits were made, and I received no compensation tied to fund sales.