I printed 50 copies of The Adviser's Guide To Seeding an ETF In-Kind

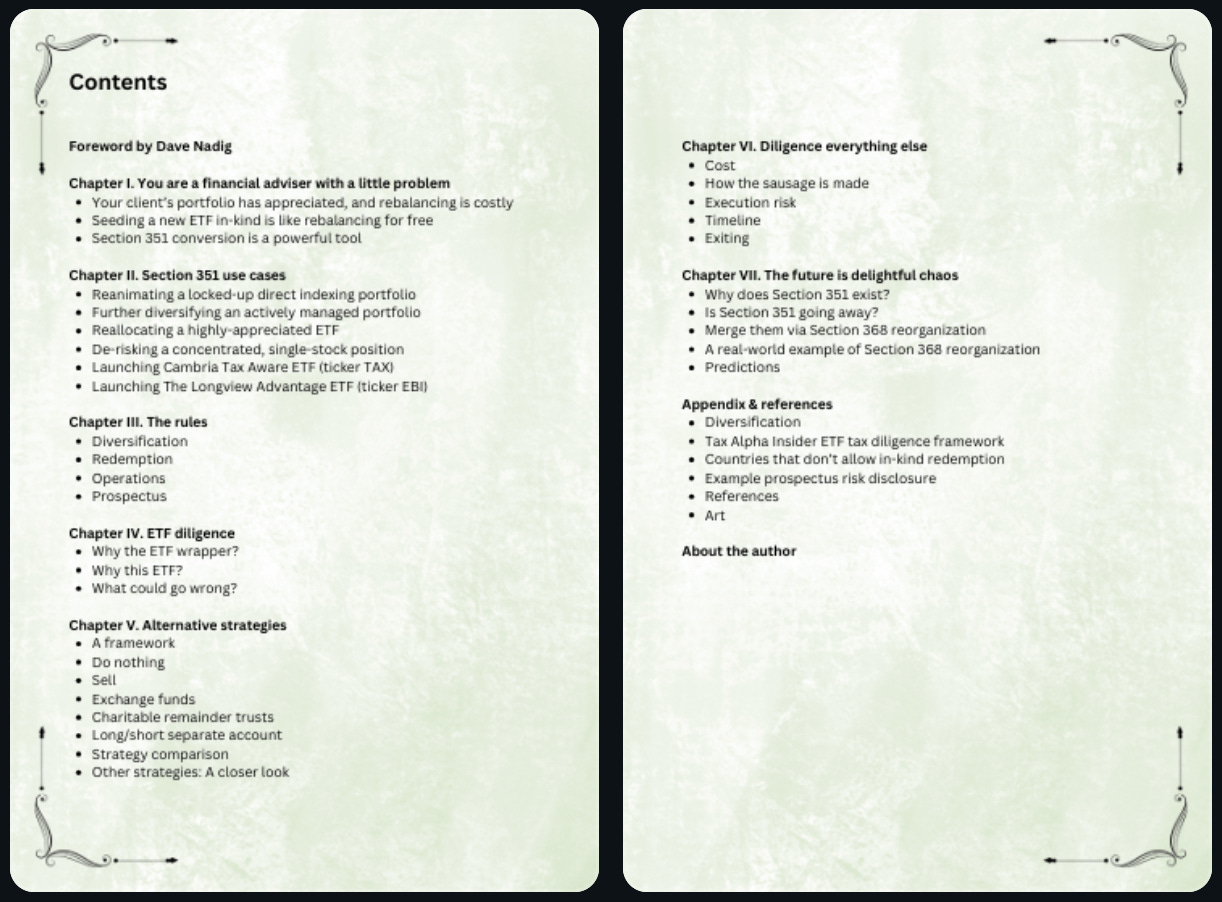

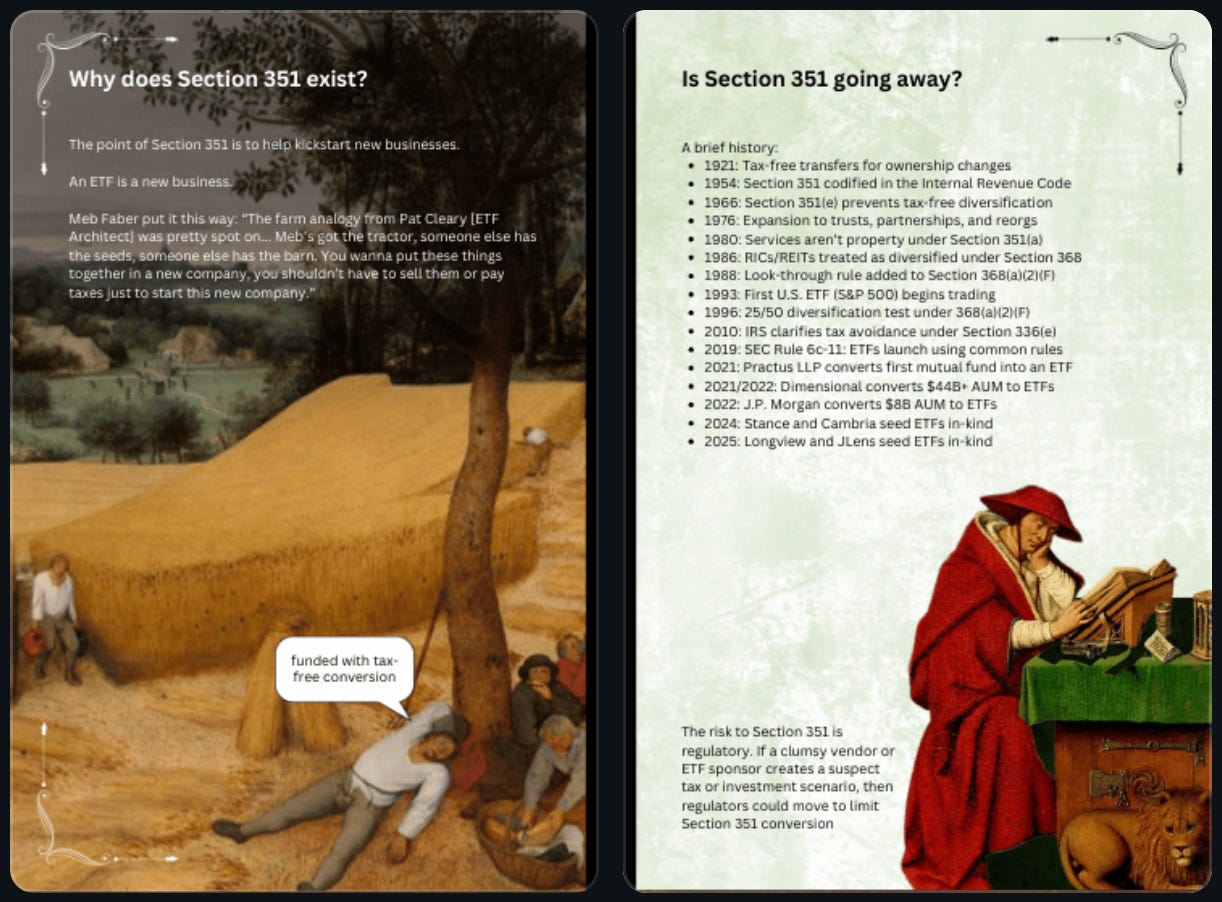

70 pages of full-color print. What the heck is Section 368 consolidation?

I printed 50 copies of The Adviser's Guide To Seeding an ETF In-Kind

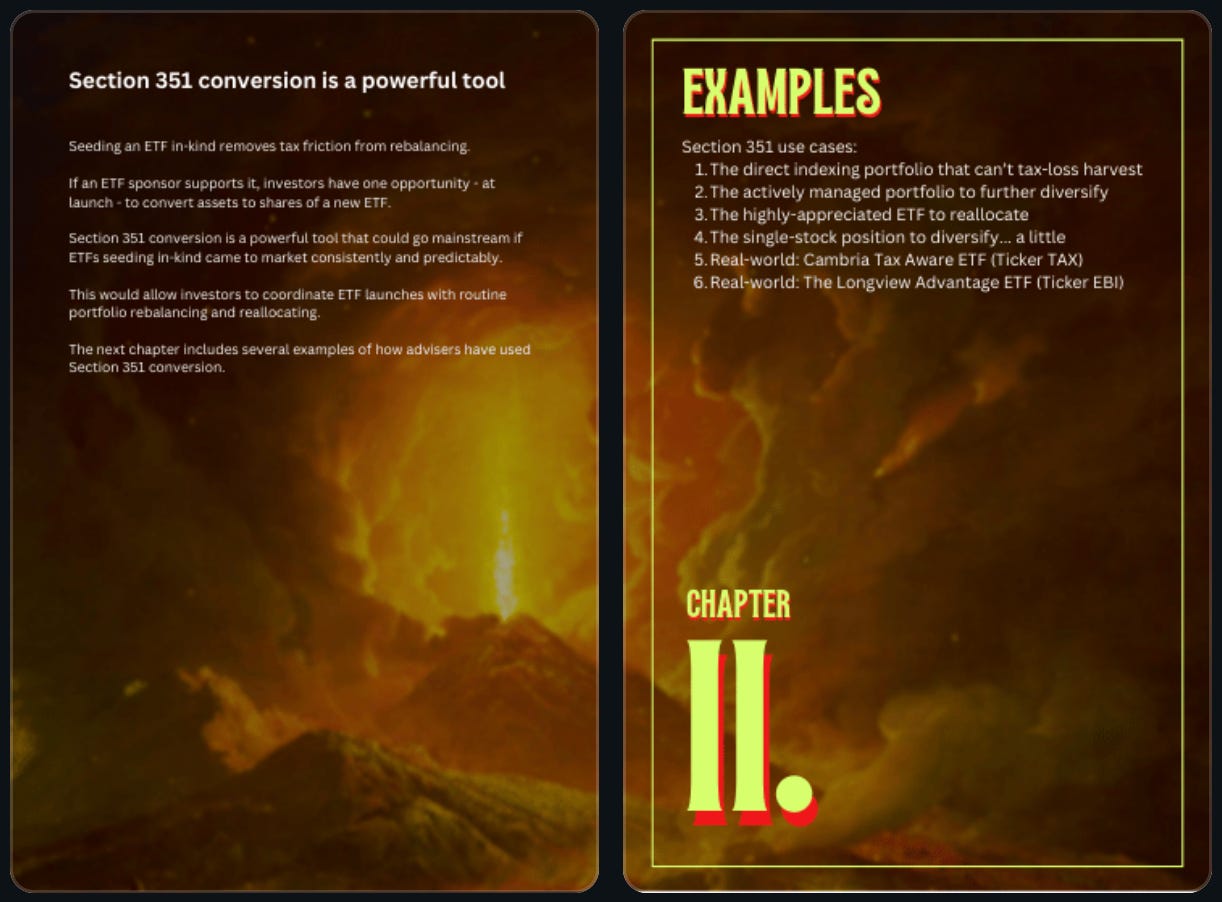

Two pages in my book are dedicated to a possible future where clones of ETFs seeded in-kind consolidate using Section 368.

It’s been done. The folks at Stance Capital seeded an ETF in-kind via Section 351 late last year and are consolidating with another ETF using Section 368.

That story, plus tons of memes, concepts, and examples are physically available thanks to the folks at Girlie Press, here in Seattle.

This book took me hundreds of hours of research, conversations, styling, typsetting, and toiling. Buying a copy covers printing (full color, nice paper) and shipping (about $7 media mail).

I shipped two copies yesteray.

Here’s the TOC and some pages…

Jokes about tax-loss harvesting

I posted this, and many people had thoughts.

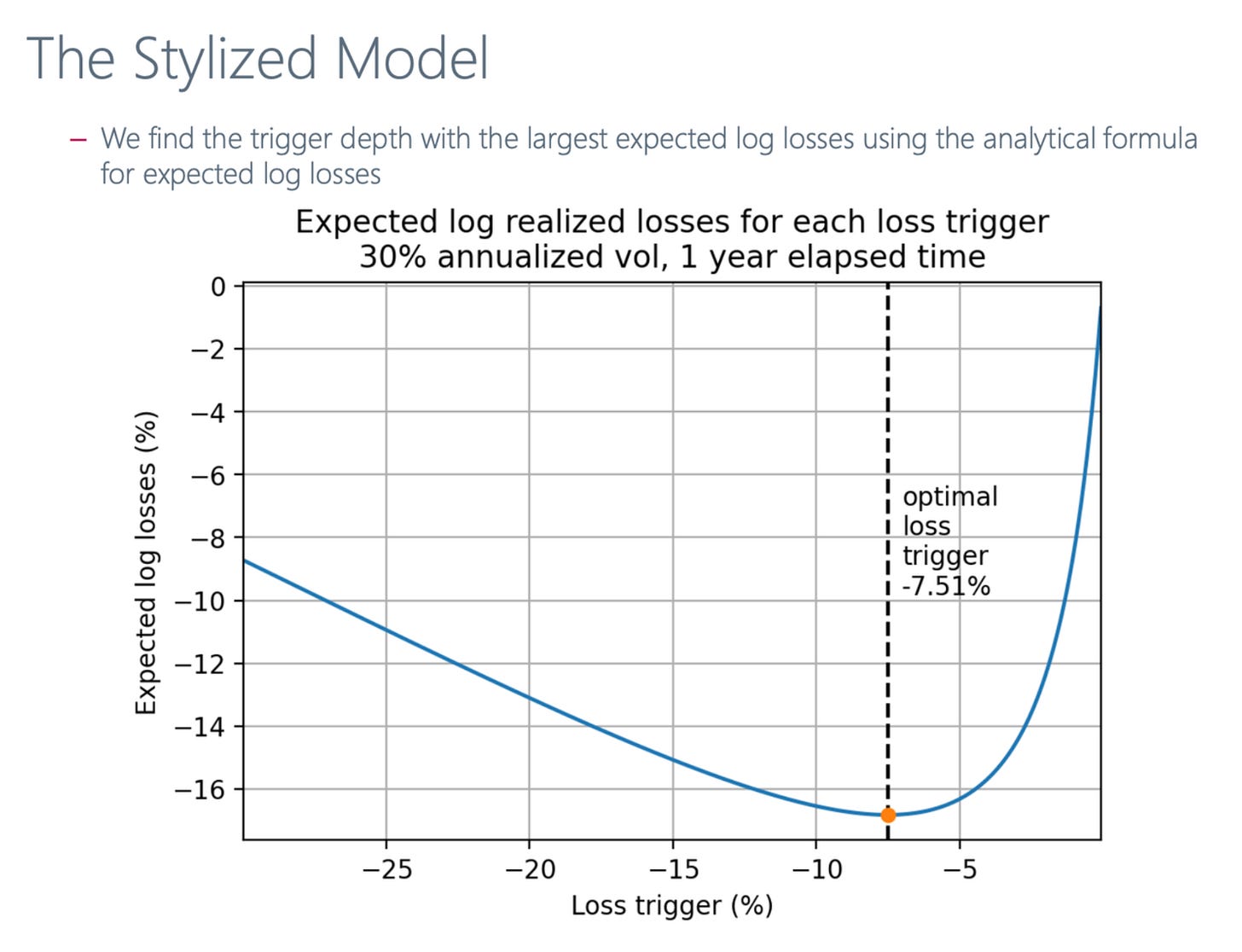

Optimal timing of tax-loss harvesting is a big topic. The kernel underpinning timing is tax-loss harvesting’s analogy with an American put option. It’s not a perfect analogy, but is pretty close.

What’s the best practice for optimally timing exercise of an American put option. Clarity came from my friends at Parametric.

p.s. Thanks to Brandon Koepke, CFA 🇨🇦 for the heads up.

I’ll have more to say on the complex interaction between tax-loss harvesting, tax-gain harvesting, and how they impact portfolio lock-in in the coming weeks. It’s a component of my research into tax-aware long/short strategies like the 130/30 and 250/150.

Stay tuned…

Hi Brent, I purchased a book but did not get a receipt. How can I contact you?